A. Enkhjin, Director of the Financial Market Department at the Mongol Bank, shared insights on the current state and future prospects of the gold market.

The global economy is currently facing Increased uncertainty and weakness, driven by potential risks such as geopolitical tensions and trade tariffs. How effective is gold as an asset in this context, and what kind of returns can investors expect?

Gold is a unique investment instrument that acts as a safeguard for national currencies and plays a vital role in the foreign exchange reserves of central banks worldwide. By including gold in their reserves, central banks are able to diversify their asset portfolios and reduce concentration risk.

As part of its core responsibility to manage the country's foreign exchange reserves, the Mongol Bank boosts its reserves by purchasing domestically mined gold, refining it at internationally recognized refineries, and then monetizing it.

Of course, the price of gold on international financial markets fluctuates due to a variety of factors, including geopolitical conditions, the monetary policies of leading economies, inflation, the overall economic environment, and market uncertainty. Based on accounting for these variables, the optimal proportion of gold in foreign exchange reserves is determined and managed within an approved framework.

In recent years, central banks have steadily increased their gold reserves. In 2021, central banks worldwide purchased 473.3 tons of gold, representing 11% of total global demand. However, in 2022, this figure surged to 1,082 tons, accounting for 23% of total demand.

In 2023, global gold purchases by central banks reached 1,037 tons, with a continuing upward trend expected. The United States leads the world in gold reserves, holding a total of 8,133 tons, followed by Germany (3,355 tons), Italy (2,451 tons), and France (2,437 tons). China, which has rapidly increased its gold purchases in recent years, ranks fifth with reserves of 2,279 tons. Over the past five years, Mongolia has purchased an average of around 20 tons of gold annually from the domestic market, increasing its foreign exchange reserves by approximately $900 million each year.

How many tons of gold are mined globally each year?

Total global gold production reached 217,000 tons by the end of 2024. Of this, 45% is used for jewelry, 22% for gold bars and coins, and 17% is held in central bank reserves. In Mongolia, gold production and the amount of gold sold to the Mongol Bank fluctuate based on seasonal trends, with gold prices typically rising in the second and third quarters of each year.

The price of gold has been rising steadily since the start of the year, and central banks worldwide are increasing their gold purchases, further stimulating demand. How will this rise in gold prices impact Mongolia's economy? Additionally, how have gold exports, both in terms of physical volume and revenue, increased in Mongolia?

The high price of gold on the global market is having a positive impact on Mongolia's economy. In March 2025, the price of gold-one of the country's key exports reached a historic high of over $3,100 per ounce.

While several market factors influence fluctuations in gold prices, geopolitical risks, market uncertainty, and expectations surrounding U.S. dollar interest rates have recently become the primary drivers.

In 2024, geopolitical uncertainties-such as the armed conflicts in the Middle East and Ukraine, along with disruptions to payments and supply chains-coupled with expectations of a decline in the real yield of the U.S. dollar due to the Federal Reserve's interest rate cuts and the impact of U.S. tariff policies, contributed to increased market uncertainty.

Our country purchases an average of around 20 tons of precious metals each year, refining them abroad for monetization. This process directly increases export revenues by approximately $900 million annually.

Due to the depletion of our country's placer deposits, gold sales to the Mongol Bank have been on a downward trend in recent years. However, the continuous increase in gold prices on the international market has significantly contributed to the stable growth of exports in terms of total value.

Additionally, the gold content in Oyu Tolgoi's copper concentrate also plays a role in boosting Mongolia's export revenues.

What are the main factors driving the continuous increase in gold prices? How long do research institutions expect this upward trend to continue?

Gold prices are influenced by a wide range of factors. In recent years, rising global uncertainty-driven by armed conflicts, wars, and trade tensions in various regions-has boosted demand for gold, pushing its price to new historic highs. The steady increase in gold futures prices further reflects market participants' optimistic expectations for continued growth.

The increase in import tariffs imposed by the United States on its trading partners has contributed to rising inflation and raised concerns about a weakening U.S. dollar. As a result, both market participants and central banks have shown greater interest in increasing their gold reserves as a hedge against inflation. According to recent data, total gold reserves held by central banks have grown by 10% to 21%, while the share of U.S. dollars in global foreign exchange reserves has declined from 59% to 46%.

In light of the current international trade situation, U.S. President Donald Trump has begun implementing the tariff policies he promised during his election campaign. He has imposed 25% tariffs on key trading partners such as Canada and Mexico, and announced tariffs totaling 145% on imports from China, which accounts for approximately 15% of U.S. imports. These measures have raised concerns that escalating trade disputes between major economies could negatively affect global trade, commodity prices, and overall economic stability.

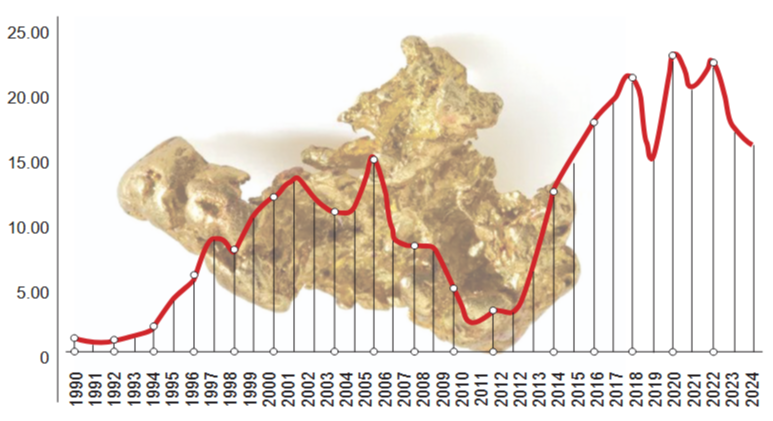

Precious Metals Acquired by the Mongol Bank (tons)

These newly imposed tariffs could, in the long run, push not only the United States but also the global economy into an economic and financial crisis. The European Union, Japan, and South Korea have expressed their willingness to engage in negotiations. In the current environment, where the risk of stagflation is rising, it is particularly significant that the U.S. Federal Reserve is expected to prioritize policies that balance inflation control and employment.

A rate cut could have a significant impact on gold prices. U.S. Secretary of the Treasury Scott Bessent has also stated that a recession cannot be ruled out, and that economic adjustment is inevitable given the ongoing policy changes.

JPMorgan, the internationally renowned bank, has reported a 40% chance of a recession in the United States. Amid challenging international trade conditions, the resumption of armed conflict between Israel and Hamas is further escalating tensions in the Middle East. Additionally, under the orders of President Donald Trump, the U.S. military has begun airstrikes against the Houthi group in Yemen, increasing the risk of further instability in the region.

Although Russia and Ukraine are in discussions over a ceasefire agreement for specific sectors, it is unlikely that a full ceasefire will be reached in the near future. Given these economic, trade, and geopolitical challenges, international investment banks and financial institutions believe that gold prices will continue to rise steadily at high levels. As the risks in the global investment environment increase and major U.S. stock market indices decline, demand for reliable investment instruments with low exchange rate risk is on the rise. Experts predict that the price of gold will remain stable in the foreseeable future.

In a volatile mineral market, gold and copper exports have been key drivers of Mongolia's export earnings growth. How can businesses, the Central Bank, and the government effectively capitalize on rising prices?

Interest in investing in this sector has grown due to the steady appreciation of gold prices in international markets. However, the price of gold, which surged to historic highs in a short period due to supply chain disruptions caused by trade wars, armed conflicts, and the weakening of the U.S. dollar, may experience a decline and undergo adjustments.

As mentioned earlier, Mongolia is experiencing a decline in gold mining due to the depletion of its remaining placer reserves. The Mongolian government plans to implement the Gold-3 campaign, aimed at boosting gold production and significantly strengthening the country's gold and foreign exchange reserves. To capitalize on rising international gold prices and increase production, it is crucial to implement policy measures that support mining within the legal framework.

As part of efforts to intensify the implementation of the Gold-2 National Program, and in accordance with the Law on the Prevention, Combating, and Mitigation of the Social and Economic Impacts of COVID-19 and Resolution No. 32 of the Parliament in 2020, Mongol Bank secured necessary resources from foreign banks and financial institutions. Between June 2020 and December 2022, it provided a total of 505.5 billion MNT in both long-and short-term concessional financing to gold mining enterprises through commercial banks.

In line with the Law "On preventing the increase in prices of some main types of commodities and products, shortages thereof, and reducing the negative effects", precious metals were purchased from the domestic market at a rate 5% above the closing price of the London Metal Exchange between April 22 and December 31, 2022. Mongol Bank has intensified the implementation of this program, purchasing 23.6 tons, 20.8 tons, and 22.9 tons of precious metals in 2020, 2021, and 2022, respectively.

Mongol Bank will collaborate with the program's stakeholders to implement the Gold-3 National Program and integrate the necessary policy changes into its precious metals purchasing procedures.