By S.Bold-Erdene Minister of Finance Ch.Ulaan announced in August that State revenue until then was MNT1.2 trillion less than what had been estimated in the budget.

Mark the figure; it is not MNT100 billion, MNT200 billion or even MNT500 billion, but a whopping MNT1.2 trillion. The shortfall has put the Human Development Fund in a critical situation and it is not clear how State-funded construction works will continue. Just before his statement, several coal companies had put exports on hold. Overall coal and iron ore prices have dropped drastically. Exports this July were 46 per cent less than they were in July, 2011 and 69 per cent less than in June, 2012. Revenue from coal was $81 million in July, $200 million less than in the previous month. The major part of our budgeted revenue comes from copper, coal and iron ore exports, so all these figures are of serious concern.

It once used to be said that if Moscow sneezes, Ulaanbaatar catches a cold. If that reflected contemporary reality, today the saying must be changed into, “If China sneezes, Ulaanbaatar gets pneumonia.” The Chinese economy, booming for the last five years, is starting to slow down. Its annual growth was at least 10 per cent for several years, but the Government of China says the economy will grow by just 7.5 per cent this year. The second largest economy of the world surely has many problems, but we shall restrict ourselves to the condition of its steel industry which uses Mongolia’s coal and iron ore.

China’s steel production grew 400 per cent in the last decade. Last year, it stood at 683.27 million tons, which was 8.9 per cent higher than in 2010. The growth continued in the first half of this year, but then came the slump, and today there are unofficial reports of several steel factories suffering a drastic revenue fall because of lower demand.

The National Development and Reform Commission of China has admitted the drop in both steel production and steel price. Some 419.46 million tons of steel was produced in the first seven months of this year, a total 8 per cent higher than in the corresponding period last year. In July, the increase dropped slightly, and was 61.7 million tons, just 1.5 million tons higher than in June. It is clear that the days of runaway growth are over for now. It may very well be steel production will not reach the planned 715 million tons by the end of the year. With lower demand, steel plants will be forced to cut production, and will require less coal, much of which has been coming from Mongolia.

Steel production costs have increased and steel price has dropped, too, with the result that the steel sector’s revenue in the first seven months of the year has decreased by 96 per cent year-on-year. Zhang Changfu, secretary general of China Steel and Iron Association, said in an interview to CNBC, “Expenses of steel plants have increased by 37 per cent and their revenue has dropped. It is difficult to make a profit with a simultaneous drop in both price and demand.” The main reason for the cost increase is the rise in price of the main raw materials, iron ore and coking coal. “In order to hold the raw material price, producers need to control the output quantity,” said Mr. Zhang. This is just what has happened. China imported 3.93 million tons of coking coal in July, which is 40 per cent lower than the previous month’s 6.49 million tons.

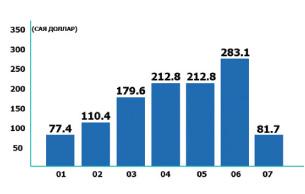

Mineral companies TAX revenue to the state budget (annual)

/billion.MNT/

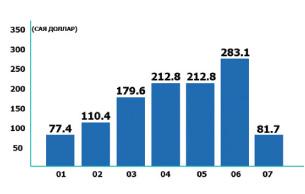

Export revenue from coal

/in first 7 months of 2012/

What is going on in Mongolia?

What is going on in Mongolia? Announcing a budget deficit of MNT1.2 trillion in Mongolia, the Minister of Finance revealed that compared to the first seven months of 2011, revenue has increased by 20 per cent this year and expenses by 55 per cent. The amount of total revenue and aid rose by MNT465 billion to stand at MNT2.7 trillion, but this was still less than what had been estimated and on the basis of what total expenditure had been allowed to increase to MNT3.3 trillion, MNT1.2 trillion more than in the corresponding period last year.

Another reason for the revenue receipts being below what was estimated is that the entities have paid less tax than calculated. In the first seven months of this year, income tax of business entities increased by MNT29 billion or by 10 per cent, while individual income tax payments grew by MNT63 billion or by 55 per cent. People paid more tax as their salaries were increased but corporate income grew only marginally. One reason for this, again, was that the private sector often had to pay their employees more following the increase in state officials’ salary and this reduced their profit.

Taxes from mining companies contribute most to the State budget, but their income has not increased as much as was anticipated. Here again, incomes, steady in the first half of the year, drastically dropped in the seventh month, as a direct result of the fall in both price and volume of coal and iron ore export.

Coal export grew consistently in the first half of the year and then dropped in July, decreasing by 46 per cent from the same period in 2011 and by 69 per cent compared to June. According to the National Statistical Office, 0.9 million tons of coal was exported, which is one-third of the previous month’s figure and half of that in July, 2011. Revenue from coal was $81 million, dropping by 3.4 times.

Prices also fell. In the last couple of months, the price of coking coal has dropped by 20 per cent. Iron ore price, which was $160 in July, dropped to $117 by the beginning of August. Analysts see it going under $100.

Mongolia expected to export 30 million tons of coal this year. It is obvious now that this goal cannot be reached. Only 11 million tons were exported by July. SouthGobi Sands LLC stopping its operations has been a major factor behind the fall in coal export. Some other companies have also been reported to have stopped exporting. Everything points out to a further drop in the second half of the year. Coal export accounts for more than 40 per cent of the total export of Mongolia, and if this is affected, obviously there would be less money for the state.