Recent news

EBRD LOWERS MONGOLIA’S GROWTH FORECAST FOR 2025

The European Bank for Reconstruction and Development (EBRD) has revised its regional economic forecast for 2025 downward by 0.2 percentage points compared to its projections from February 2025.

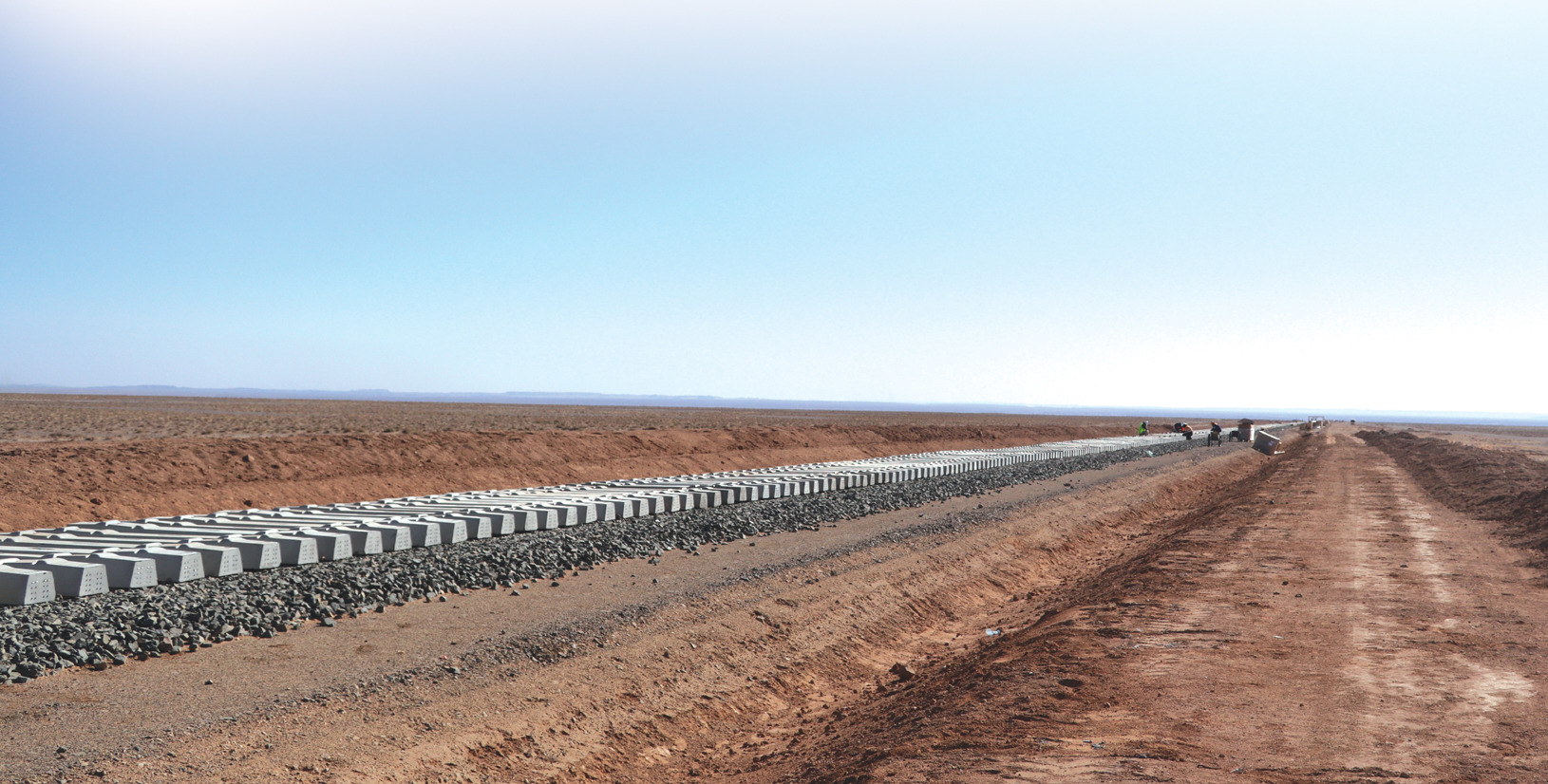

Second Agreement to Link Mongolia and China by Rail Approved After 70 Years

On March 27, Parliament discussed and approved the draft Law on Ratification of the Agreement between the Government of Mongolia and the Government of the People’s Republic of China. This focuses on cooperation for the construction of the Gashuunsukhait-Gantsmod cross-border railway, boosting coal trade, and expanding the capacity of the Tavan Tolgoi coal mine.

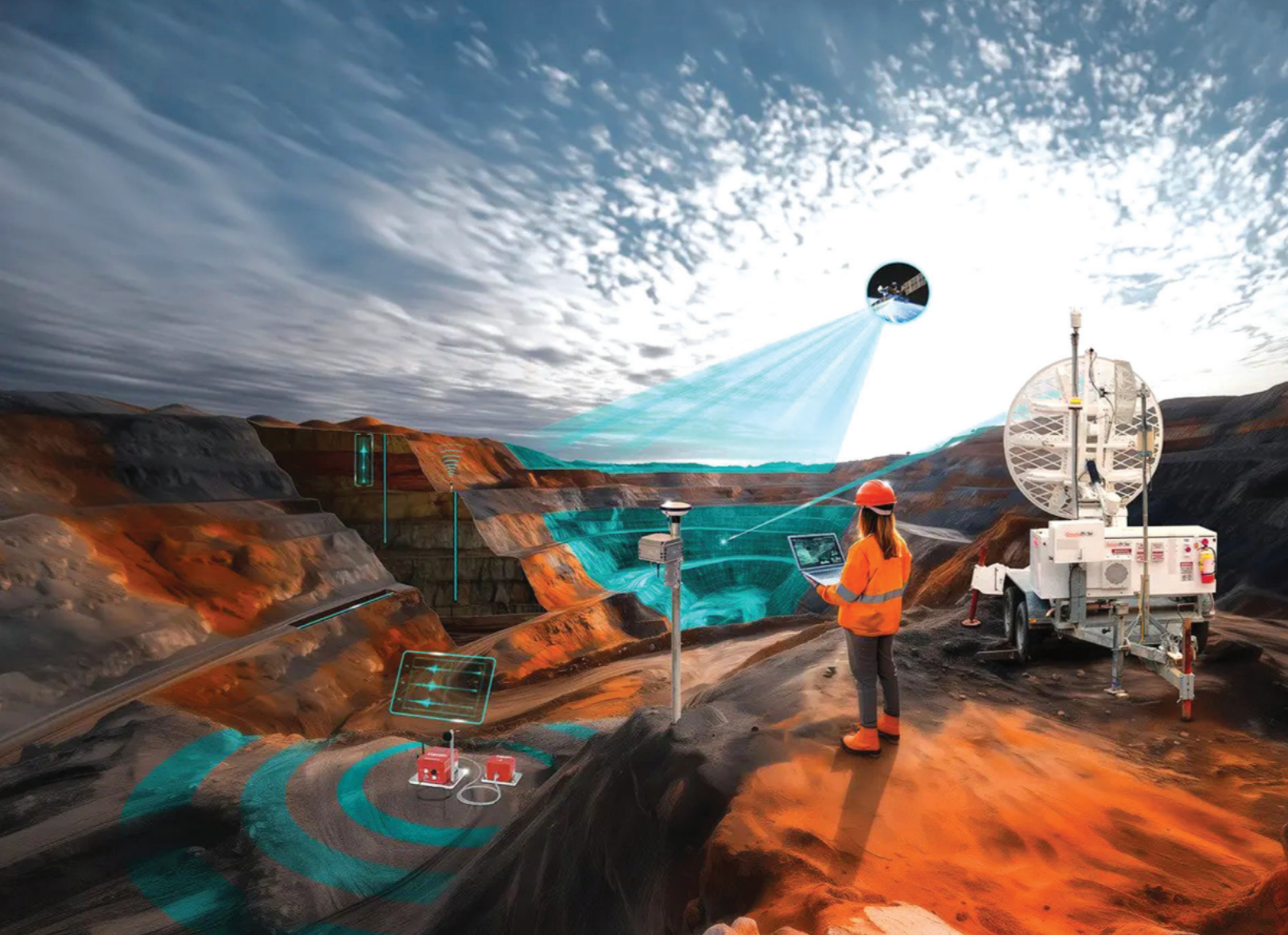

RIO TINTO WEIGHS UP RARE EARTHS MARKET

Rio Tinto (ASX: RIO) is weighing a move into rare earths and other critical minerals as it responds to shifting global market dynamics and trade tensions. Following the company’s annual general meeting in Perth on Thursday, chief executive Jakob Stausholm said the board had discussed rare earths this week and would take a “serious look” at their potential role in Rio Tinto’s portfolio.

UNITED AIRLINES TO LAUNCH FLIGHTS TO MONGOLIA

In 2023, Mongolia and the United States signed a long-anticipated “Open Sky” agreement after more than 20 years of negotiations. This intergovernmental aviation deal paved the way for stronger air connectivity between the two countries.

Rio Tinto paid 482 million USD in Mongolian taxes and royalties in 2024

Rio Tinto is committed to ensuring that all stakeholders benefit from the company’s success. This commitment is reflected in the way the company prioritizes the well-being of its employees, protects the environment, supports the communities in which it operates, and responsibly rehabilitates land at the end of its operational life.

Preliminary Estimates of Economic Risks

It is impossible to predict with certainty the changes that may unfold in the global economy in the second half of 2025, or whether the direction of Mongolia's economy situation worsen or improve. It is equally difficult to calculate how the U.S. President's tariff policy, which is putting pressure on our neighboring countries and key business partners, will impact Mongolia, particularly through our main export market, China.