A. Khaliun

It is time to assess the changes and reforms in Mongolia’s economy Mongolia during 2023. The national economy grew by 6.4% in the first half of 2023, and activity improved further in the third quarter, with growth reaching 6.9%. This was mainly influenced by the recovery of the mining and transportation sectors, and growth is expected to continue until the end of the year, emphasized B. Lkhagvasuren, President of the Mongol Bank, presenting the decision made by the Monetary Policy Committee 2023.

In the year of the pandemic in 2020, Mongolia’s economy shrank by 4.6%, but it gradually recovered and grew by 1.6% in 2021 and 4.8% in 2022.

We are providing an overview of the factors contributing to economic growth exceeding expectations and estimates in 2023 and key developments in the economic sector.

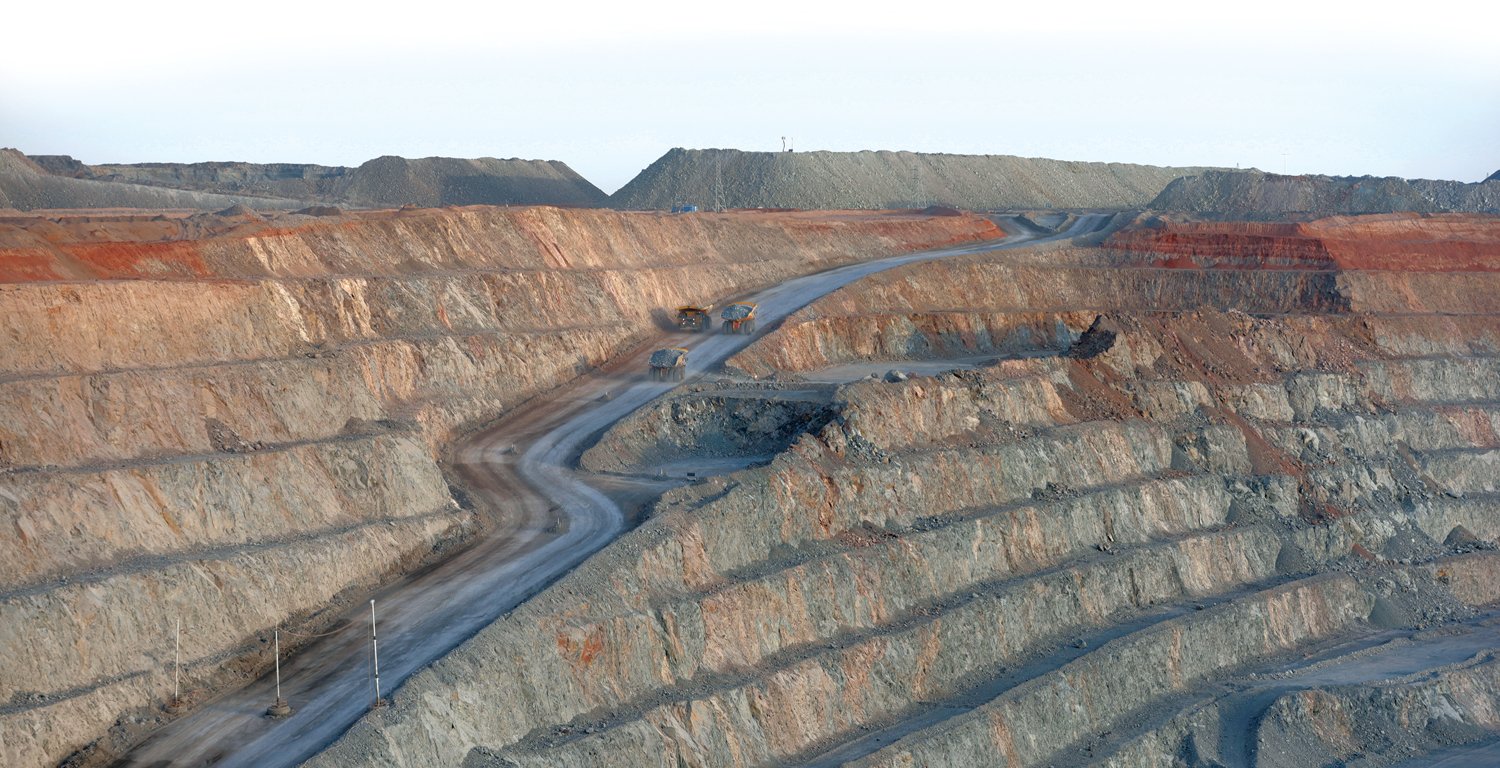

Oyutolgoi launches underground mining operations

Last March, a ceremony was held to begin underground mining to extract 80% of the total reserves, or the highest-grade ore from the Oyutolgoi mine. The ceremony was attended by Prime Minister L. Oyun-Erdene and other cabinet members representing the Mongolian government, which owns a 34% stake in the mine, as well as Jacob Stausholm, CEO of the 150-year-old Rio Tinto Group, managers and miners of Oyutolgoi LLC, which owns a 66% stake in the mine.

Oyutolgoi started open-pit mining in 2013 and then introduced technology to extract ore from 1.3 kilometers underground. “In the coming years, we will gradually increase the volume of ore extracted from underground mines, and when production reaches its peak, Oyutolgoi will become the fourth largest copper mine in the world,” emphasized B. Bold, Director of Rio Tinto Copper Group.

Oyutolgoi conducts underground mining using the most modern and safe block mining method in the global mining industry.

Oyutolgoi LLC set a target of producing 113,691 tons of copper concentrate in the third quarter of 2023 and exceeded it, producing 127,419 tons.. If we maintain this pace, we could reach peak production earlier than 2030 and become one of the largest mines in the world, producing 95,000 tons of ore per day, in the Gobi, in Mongolia.

Countries around the world are unanimously supporting initiatives to combat global warming and climate change. For this reason, the use of renewable energy sources and the production of environmentally friendly electric vehicles are on the rise, increasing demand for copper. u

Global copper consumption is estimated to peak in 2035. At that time, Oyutolgoi is expected to be operating at full capacity and 2023 is the start of growth in copper exports from Mongolia.

Coal trading on the exchange successfully launched

The Mineral Exchange Law, approved by Parliament in December 2022, came into effect on July 1, 2023. Aimed at increasing the value of mining products and increasing export revenues, it started with coal exports. Accordingly, cooperation with China began in February with an experiment to sell coal from state-owned companies on the exchange.

Previously, we used to sell coal at the mine mouth very cheaply, at an average of $60-70 per ton, and Chinese companies were in charge of transportation. As of this year, domestic companies have started to manage coal transportation, which was the right economic policy to keep transportation revenues in the country.

At the same time as trading on the exchange, coal was sold at the border price rather than the mine mouth price, which benefited the economy.

As of November 16, a total of 11.1 million tons of coal had been sold on the Mongolian Stock Exchange since online coal trading began. Erdenes Tavantolgoi JSC sold 8 million tons, or about 72% of the total trading volume, and reported sales of 1.1 billion dollars.

Exchange trading increases competition and raises prices. For example, Erdenes Tavantolgoi offered to sell one ton of coal at $138 on November 16 and ended up selling a total of 160,000 tons of coal at $140 per ton. Therefore, the government plans to start trading 30% of the total coal for export on the exchange, and this volume will gradually increase. We are expanding the range of products to be traded on the exchange and are preparing to trade copper concentrate on the exchange in 2024.

Mongolia exported a record 62 million tons of coal in 2023

In 2023, Mongolia exported 62 million tons of coal, setting a historical record. The mining sector, including coal revenues, accounts for 93% of Mongolia’s export revenue. Hence, coal was a key contributor to the economic growth of 6.9% this year..

The Minister of Economy and Development Ch. Khurelbaatar said that exporting 47 million tons of coal in the first nine months of 2023 was a significant achievement and added that the figure could reach 52 million tons by the end of the year and, if the parties work hard, even 60 million tons could be exported. Not only did Khurelbaatar’s prediction come true, but the plan was exceeded on New Year’s Eve.

Thanks to increased revenues from coal and other mineral exports, the balance of payments in the first half of 2023 showed a surplus of $66.2 million and foreign exchange reserves increased, a positive signal of economic recovery.

During this favorable economic period, the government amended the state budget for 2023. It was decided to give money to 9% of children who do not receive child support, i.e. all children, and 167 billion MNT was allocated for this purpose.

Measures were also taken to increase pensions, benefits and salaries of civil servants, for which an additional 1.8 trillion MNT was budgeted. Increasing the salaries and pensions of citizens through mining revenues was the right decision that met the expectations of people affected by price hikes.

Investors were again invited to Mongolia

At the Mining Week Forum held in October, it was evident that the government is focusing on attracting foreign investment in 2023.

Members of the Government, led by the Prime Minister, actively participated in the economic conference organized within the framework of the “Year to Visit Mongolia” initiative and just before the Naadam Festival. On this occasion, the government presented investment opportunities in many sectors, not only in the mining sector, but also in tourism and renewable energy sectors.

More than 100 representatives from 45 major global banks and financial institutions such as JP Morgan, Goldman Sachs, Morgan Stanley, CITI, Barclays and HSBC attended the economic conference at the invitation of Rio Tinto Group, an investor in Mongolia.

The attitude of investors to support a business-friendly legal environment and businesses that take into account global development trends may have made our policy makers think.

Three months after the Economic Conference, the Mongolian Mining Week 2023 conference began. Three thousand people attended, including investors, representatives of the public and private sectors of the global mining industry, the Mongolian government, ambassadors to Mongolia and representatives of international organizations working in Mongolia. Approximately 300 foreign guests came from about 20 countries including Australia, Austria, the United States, China, the UAE, the Republic of Korea, Germany, the United Kingdom, Spain, Canada, the Russian Federation, South Africa, Pakistan, France, India, and Japan.

The conference was organized for the second year by the Ministry of Mining and Heavy Industry and the Mongolian National Mining Association. The organizers and participants discussed and analyzed our country’s mineral resources for each type, including coal, gold, copper and uranium.

The opening speech by the President of Mongolia, U. Khurelsukh, and the speech by the Minister of Mining and Heavy Industry, J. Ganbaatar, demonstrated that Mongolia will pursue a policy of processing its mineral resources and exporting them as high value-added end products.

In 2023, the government amended the draft Investment Law and submitted it to the Parliament. The Minister of Economy and Development Ch. Khurelbaatar explained that the draft law will support foreign investors in all aspects, take into account the risks that investors may face, and uphold the principle of mutually beneficial cooperation.

It is also a great achievement that cases of harm to investors are discussed and resolved at the government level on a quarterly basis. This year we received 67 complaints from investors, 14 of which were resolved. Foreigners are very interested in investing in the mining sector of our country, and 50% of all complaints were related to the mining sector, which confirms this trend.

Zuuvch-Ovoo - a new project to promote Mongolia to the world

The Secretary of the Nuclear Energy Commission G. Manlayjav emphasized that Mongolia has the potential to become a new uranium player in the global mineral market. He said these words after French President Emmanuel Macron’s state visit this May.. The heads of state of the two countries agreed to cooperate in a number of areas, including uranium mining.

To make this cooperation a reality is the Zuuvch-Ovoo mine owned by Badrakh Energy LLC, whose investor is the French group Orano Mining. The company is conducting exploration in Dornogobi aimag and has been licensed to hold three uranium deposits. The first of these is the Zuuvch-Ovoo deposit, located more than 100 kilometers south of Sainshand, on the border of the Ulaanbadrakh and Zuunbayan soums. It is expected that 70,000 tons of uranium will be extracted from Zuuvch-Ovoo over 38 years of mining.

Five months after the visit of the French head of state, Mongolian President U. Khurelsukh made his first state visit to the country last October at the invitation of President Macron. During that visit, Mr. S. Narantsogt, Executive Director of Erdenes Mongolia, signed the protocol of negotiations of the working group for the preparation of the draft investment agreement between the Government of Mongolia and Orano Mining.

As a result, the work on the conclusion of the Investment Agreement has moved one step forward, and now the members of the working group are drafting the Investment Agreement. On the Mongolian side, the working group was headed by the Minister of Justice and Internal Affairs Kh. Nyambaatar. When he moved to the position of Governor of Ulaanbaatar, the next Minister B. Enkhbayar is now in charge.

GDP per capita reached $5000

In 2021, the year of the Covid pandemic, Mongolia’s economy shrank by 4.7%, but ahead of the new year, it grew by 6.9%, with GDP per capita reaching $5,000. Prime Minister L. Oyun-Erdene and members of his cabinet announced this last September at a meeting with Mongolia’s development partners such as the Asian Development Bank, the World Bank, the IMF, the European Bank for Reconstruction, the United Nations Development Program and foreign ambassadors, and expressed their gratitude for supporting Mongolia’s development.

Finance Minister B. Javkhlan announced at the time that the government would implement a policy of economic expansion in 2024 and set a target of $6,000 GDP per capita.

The recovery or decline of our country’s economy in the near future will be heavily dependent on the mining industry. The reality is that if the price of mineral resources is stable in the world market and the economic performance of our neighbor China is positive, it will have a favorable impact on Mongolia’s economy. In 2023, the balance of payments turned positive for the first time due to improved mineral supplies and higher prices.

We enter the new year with good news: Mongol Bank’s foreign exchange reserves reached $4.4 billion.

CENTURY II AND III BONDS ISSUED AMIDST SUCCESSFUL DEBT REFINANCING

2023 brought high pressure on the government to repay foreign debt. In January this year, under the Century II project, the government issued $650 million worth of bonds, redeemed part of the Khuraldai and Gerege bonds, and managed to successfully settle the debt, avoiding the risk of default.

In December 2022, the government repaid the $1.5 billion loan on the Chinggis bonds. In May 2023, $368.7 million representing the outstanding balance of the $800 million bond debt received in 2017 was repaid in full and foreign currency reserves for the repayment of the Gerege bonds were made under the Century-II project.

Between November 20 and November 28 of this year, the remaining $392.5 million of Khuraldai bonds were refinanced as part of the Century III project and the debt was successfully adjusted.

On November 28, 2023, the Government placed $350 million of Century III bonds in the international financial market with an interest rate of 7.875% for a term of 5.5 years and repurchased certain portions of the remaining $392.5 million of Huraldai bonds scheduled to mature in March 2024.

The Finance Minister noted that total orders from international investors for the newly issued Century III bonds reached $4.8 billion, the highest in history and 13.7 times the previous record.

Following the successful implementation of the Century-III project, Mongolia will not make bond payments in 2024 and 2025. The project was implemented in cooperation with international investment banks J.P. Morgan and HSBC.

You may recall that on October 23, the Development Bank’s $500 million Euro bond debt was fully repaid from its own funds. This is important proof that Mongolia is able to fulfill its obligations to investors.

Mongolian Prime Minister L. Oyun-Erdene confirmed that Mongolia fully repaid its 30 billion yen or $200 million Samurai bond debt with its own funds on December 25.

On New Year’s Eve, it was announced that the government was able to completely rid itself of the burden of foreign debt by settling loan repayments totaling 13.3 trillion MNT over four years.