B.Tugs

The Oyu Tolgoi Technical Report 2020, uploaded on the company’s website on 28 August, sees extraction at the open pit mine – Oyut -- and at the underground mine -- Hugo North Lift 1 – ending in 2051, six years earlier than what was indicated in the 2016 report, bringing expected gross revenue from sale of concentrate down to $69.4 billion from $82.8 billion. The extraction schedule in the new report incorporates the effects of the change in the underground mine design but does not take into account the impact of the pandemic on production.

Work on developing the underground mine has not stopped despite the pandemic, though it goes on at a slower pace, especially in Shaft 3 and 4 construction. In the meantime, Turquoise Hill published a revised OT feasibility study in July and followed this up with the updated Technical Report.

The new report does not say anything about operations in sections such as Hugo South, Heruga and others. The previous report had said extraction would continue for 40 years from 2017, that is up to 2057, and now the mine life has been shortened by six years.

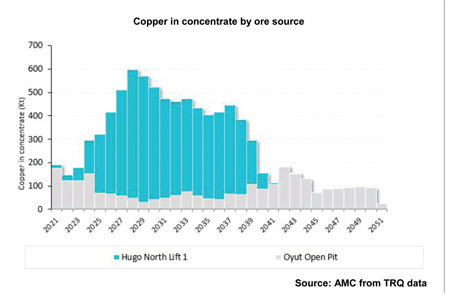

The underground mine is expected to begin sustainable production in February 2023 but full production would not be before the first half of 2029. Once that is achieved, 95,000 tonnes of ore would be extracted from the underground mine per day, taking the annual output to 33 million tonnes. Work at the underground mine – Hugo North Lift 1 -- will end in 2043, after a total of 440 million tonnes of ore has been extracted.

The open pit mine would be producing 40 million tonnes of ore per annum until 2023. Output would be gradually reduced with start of extraction in the underground mine, but will not be stopped totally.

From first sales in July 2013 until January 2020, a total of 4.6 million tonnes of concentrate was sold, but 1.23 billion tonnes of ore will be extracted and processed in 2021-2051 to get 31 million tonnes of concentrate. This concentrate will contain, at a rough estimate, 8.8 million tonnes of copper, 8.5 million ounces (~264 tonnes) of gold, and 52 million ounces (~1600 tonnes) of silver.

The concentration plant will process around 40 million tonnes of ore per year during the life of the mine, but the copper and gold content would start falling after 2040, except for 2042 when the gold content would be much higher than average.

The peak earning year would be 2028, with sales of $4.74 billion. That year, production of copper in concentrate would reach 580,000 tonnes, which is 314% higher than the current figure, and that of gold in concentrate would likely be 570,000 ounces (~18 tonnes). That ‘super cycle’ will last until 2040, with annual sales of $2 billion or more. All these figures are based on the assumption that the price of copper would be $3.08 per pound (~$6900 per tonne), of gold $1292 per ounce, and of silver $19 per ounce. These could, of course, be both higher or lower.

OT currently uses 187MW of power, but this would go up to 230MW during the ‘super cycle’. As for water, the mine is entitled to use water from the Gunii Hooloi aquifer at level of 918 l/sec, but an updated study says the aquifer can allow up to 1415 l/sec.

The report mentions that sales could be affected if the concentrate fails to meet Chinese import standards. As of now, the arsenic level is within acceptable limits but those of lead, cadmium, and mercury are being reviewed. The total dependence on Chinese buyers is another risk, and the company says it hopes to be able to reach third markets through Chinese and Russian ports.

OT has earmarked $1.3 billion as mine closure costs, to be spent over a period of 15 years.

The loss to Mongolia from the shorter life of the mine could be offset if the company opts to develop other sections of the mine. This, however, is a big decision that can be taken only after an evaluation of both political and commercial factors, both of which are unpredictable now.