B.Tugsbilegt

Taking full advantage of the surge in mineral exports, the ruling Mongolian People’s Party has prepared the 2020 budget as a typical election year exercise, hoping to impress voters by generous public expenditure. No one should be surprised that all IMF warnings not to give in to electoral compulsions and pleadings to stick to a tight fiscal policy and improve fiscal discipline have been ignored.

The Finance Minister may well say that the budget shows a rise in revenue also and even if he spends more, at 5.1% of GDP the estimated deficit is still within acceptable limits. However, the deficit is higher if the accrual of amounts (totalling MNT1.1 trillion) from the Fiscal Stability and Future Heritage funds is kept out when revenue is computed or if this accrual is treated as expenditure on the ground that the transfer of money at the Government’s disposal is also a form of spending.

The budget draft was submitted to Parliament on 26 September and at the time of writing, is being discussed by members. They might have taken note of how several economists have been critical of the rise in expenditure while warning that the revenue is vulnerable to external factors.

There will be no internal bonds next year; instead, the total amount of MNT478.8 billion remaining in the Fiscal Stability Fund will be used for the purpose. The last time the government dipped into the fund to balance the budget was in 2017, but this was when the economy was weak, and doing it when the economic situation is relatively good is certainly not a bright idea.

Both expenditure and revenue in the draft that is now being discussed by MPs are MNT675 billion over the limits approved on 30 May 2019.

Budgetary Framework Amendment 2020

(submitted on 26 September 2019, in MNTbillion)

State budget projection 2020 2021 2022

Equilibrated revenue 11,797.8 12,826.7 13,773.6

Upper limit of expenditure 13,872.6 14,089.7 14,502.4

Defict as GDP percentage 2,074.7 (5.1%) 1,262.9 (2.8%) 728.9 (1.4%)

The Finance Ministry once said that any drastic cut in expenditure would have a bad impact on our people’s life. The ruling party must be betting on the voter taking the logic to the next step and believing that more spending by the government would make their life better. One cannot be sure of this, though, as the Democratic Party, then in power, had raised a really big amount from selling bonds, and developed infrastructure, including building paved roads in UB and rural areas, but still lost badly in the 2016 election. Some felt that the DP plan misfired as Mongolians did not like being in debt. That could be one reason why this time the MPP is not going to raise money from bonds but is making the increased spending a part of the normal budgetary process.

Incidentally, the Finance Ministry has clarified that Mongolia being put on the “gray list” by the 39-member international Financial Action Task Force (FATF) will not necessitate any change to the budget.

Coal and gold surge offsets copper weakness

Mining sector revenue in the 2020 budget has been put at MNT3.2 trillion, which is MNT194.5 billion more than what it is in the present year’s budget. The estimate is that 42 million tonnes of coal will be exported for MNT1.5 trillion, both volume and revenue reaching a record high. The 2019 revenue is expected to be MNT1.3 trillion. The National Audit Office has, however, put a damper on these high hopes by warning that it would be difficult to achieve the projected volume of coal export next year.

The 2020 budget estimates the revenue from copper to be MNT1.16 trillion, MNT150 billion less than the 2019 expectations. This 12.5% drop will mostly be because of lower prices, with the average estimated at $5991/t, and lower ore grades from both Erdenet and Oyu Tolgoi. Revenue from the gold sector is estimated to double next year and that from other minerals will also be higher. The bottom line is that the increased income from coal will offset the fall in the income from copper, and as gold and other minerals are expected to earn considerably more, a significant increase in mining revenue is very much on the cards. Mining sector revenue accounts for 24.8% of the budget revenue. u

Mining revenue 2020 ( in MNTbillion)

Major mineral products export outlook

The two Funds, and a break from bonds

The Fiscal Stability Fund is estimated to receive MNT125 billion next year as against the MNT322 billion expected this year. This is a 60% drop, mainly because the equilibrated price of copper ($6290.5/t) has been set at 4.7% higher than the average market price ($5991/t). So the only contribution to the fund next year may very well be from coal, provided its estimated prices agree with those on the ground. That may not happen as many financial organizations foresee a $150/t fall in Australian coking coal prices in 2020, and the likelihood that Chinese domestic coking coal prices would also be less.

As for the Future Heritage Fund, it will receive MNT977 billion next year including MNT155 billion as dividend from state-owned enterprises -- MNT150 billion from Erdenet Mining and MNT5 billion from Mongolrostsvetment. The remaining MNT792 billion would come mostly from royalties, with interest payment accounting for MNT30 billion.

No major external bond repayment is due next year, giving the Finance Ministry a breathing space before finding $2.9 billion for repayments between 2021 and 2024. The government has put a brave face on it, claiming this will not be a strain on the economy.

№ External securities Value Coupon Maturity date

1 Mazaalai $500 mln 10.875% 2021.04.06

2 Chinggis $1,000 mln 5.125% 2022.12.05

3 Gerege $800 mln 5.625% 2023.04.26

4 Khuraldai $600 mln 8.750% 2024.03.09

Next year the government is scheduled to receive MNT2.56 trillion in loans, MNT1.267 trillion from the IMF bailout programme and MNT1.297 trillion from foreign loans or grants. As against this, MNT263 billion will fall due as internal bond repayment and another MNT705 billion as foreign loan repayment. The interest on external and internal loans will be MNT959.8 billion which would be equal to 10 percent of the total budget revenue in 2020.

Local Development Fund to get MNT44 billion more

Next year the General Local Development Fund will receive MNT188.4 billion, MNT44 billion more than this year. Most of this will come from royalties (MNT64.7 billion), while MNT24.8 billion will be from licence fees, and another MNT35.9 billion from computing the 10% royalties difference. Yet another MNT11.9 billion will come from petroleum royalties. This will be the first time money is to go to the Fund from three accounts -- the 10% difference, 50% of extraction licence fees, and 100% of exploration licence fees in place of the present 50%.

The Finance Ministry is confident that the revenue target for 2020 will be met and there would be no need to float domestic bonds to raise money to plug the budget deficit. We shall have to wait and see how well-founded this confidence is. Neither the US-China trade war, nor the economic uncertainties in the Eurozone bode well for the commodity market and we do not know what provisions are made for dealing with unexpected international developments. IMF regularly warns that the debt pressure is still strong and dependence on mineral export too high.

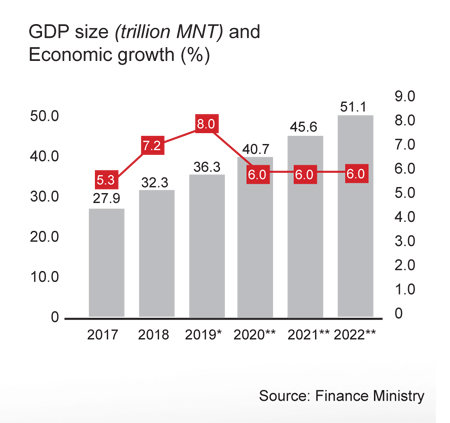

As the economy expands, maintaining even a modest rate of growth becomes more difficult. There is general agreement among analysts that the economy will grow at a slower 6% next year. Mining sector growth will be slower as ore from Oyu Tolgoi will have lower gold grades and Mongolbank has warned that mineral products prices, except that of gold, will fall. And no matter what the government says, our debts cannot be repaid in full on schedule. They will have to be carried over with some refinancing. In the ultimate analysis, our foreign loans are being used to take care of the budget deficit, and if revenue falls, it becomes essential for the government to ensure spending is done efficiently.

And how certain can we be that coal exports will take a big leap? When upgrading work at Gashuunsukhait is completed next year, border crossing capacity would be doubled, but experts feel that improved infrastructure alone cannot make a “surge”. That needs bilateral understanding and commitment at the government level, of which we see little. In addition, the National Audit Office has noted that the results of customs and tax reforms will not be felt overnight, but will take some time to be effective.

It is easy to see the 2020 budget as a feel-good document in an election year. The MPP wants people to be happy at the thought that there is enough for us to be able to spend at will. But such euphoria is always short-lived, while the job of a responsible government is to put in place a long-term policy of fiscal prudence. Problems and challenges should be resolved, not deferred or denied. After almost four years of blaming the DP for having led the country to an economic mess and making little concrete effort to clean things up, the MPP wants to get out of that mess by a splurge in spending that nobody is sure the country can or should afford. Approving the 2020 budget as it is drafted might give the impression that we are doing well, but it might not lead to actual progress.