We give below some salient points in the speeches and presentations at the last Discover Mongolia, as compiled by E.Odjargal at the 17th session of the annual international conference, intended to spread information and awareness about Mongolian mining and attract foreign investment.

G.Nandinjargal, State Secretary in the Ministry of Mining and Heavy Industry, who formally opened the event:

“The Government of Mongolia is working on creating a friendly, open and transparent legal environment for investors, ensuring economic stability and creating a system that would protect business interests. Despite the need to diversify the economy, mining will undoubtedly continue to be Mongolia’s leading industry in the next 20 to 30 years. At present, data is available on mineral resources in 20% of the total territory of Mongolia. The results of exploration work should convince investors of Mongolia’s potential. The policy of the Ministry of Mining and Heavy Industry is to grant more exploration licences and to attract foreign investment in major projects and programmes.”

A.Bilguun, Chairman of the Mongolian National Mining Association, believes that the only way for a mining-based economy to grow is by exporting more, which would increase foreign currency cash flow, create more jobs, and develop other sectors. The way to do this is to encourage investment in geology and exploration. The mineral sector is a key “weapon” of the Mongolian economy, but unfortunately, the number of extraction and exploration licences has stayed put because of society’s misunderstanding of the role and true nature of mining.

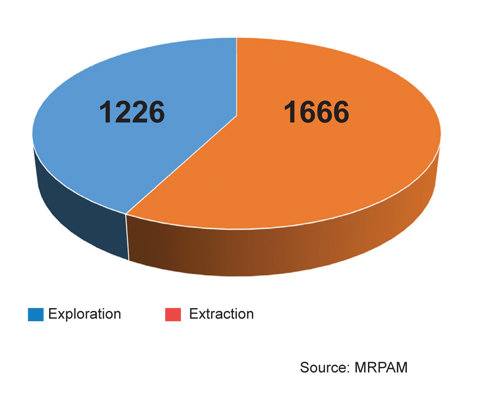

The number of total mineral licences

(as of September 3, 2019)

He warned that the situation is such that all current exploration licences will expire in the next 2-3 years, and geological exploration will be an academic concept.

T.Munkhbat, President of Geological Society of Mongolia, said that there has been restriction on grant of fresh exploration licences over the past 10 years, and exploratory geological studies have been held back mainly because of local opposition. He stressed the need for state support to attract investment in the exploration sector. Over 80 types of minerals have been discovered in Mongolia, but only around 10 of them are now being used. A rich geological formation formed a million years ago has been identified by many studies, and large deposits are waiting to be discovered. This is particularly true of the Umnugovi region where studies of sand and gravel indicate the strong probability of discovering deposits with the same rich resources as Tavan Tolgoi. These, along with the Oyu Tolgoi and Tsagaansuvarga deposits, make the region almost like Chile, and hold out promising prospects to become one of the largest mining regions in the world.

Armando Torres, CEO of Oyu Tolgoi LLC, said production at Oyu Tolgoi will be three times more than now, once the underground mine starts operating. “It will become the world’s largest underground copper mine with a block caving method. Mongolia will become a centre of high mining standards in the world. This will be another point in showing the advantage of attracting foreign investors. As for the Oyu Tolgoi project, it is most important to remember that it is Mongolian.”

Craig Lang, Principal Analyst (Base Metal) of CRU Group, noted that in 2023, which is when the Oyu Tolgoi underground mine is expected to start production, the price of copper is likely to be over $7,000 because of a shortage of copper in the world market. If Tsagaansuvarga deposit also is in operation then, Mongolia could well be in a favourable position.

“Mongolia is rich in mineral resources. Good exploration work should result in the discovery of deposits even bigger than Oyu Tolgoi.”

Sam Spring, President and CEO of Kincora Copper, whose two deposits located in the same geological area as Oyu Tolgoi and Tsagaansuvarga, Bronze Fox and East Tsagaansuvarga, are at the exploration stage, said that Bronze Fox was the first world class copper deposit discovered since 2014. Only this year alone, a total of $25 million has been invested in it. The first phase drill was carried out from July to September, and the second phase is planned for 2019-2020. The project has the potential to contain significant gold reserves in addition to copper.

Peter Akerley, President and CEO of Erdene Resource Development, which has been honoured by the Government with the Altan Gadas medal in recognition of its contribution to the exploration sector, reported on the progress of implementing the Bayan Khundii gold project in Umnugovi aimag. Both the Altan Nar and Bayan Khundii deposits lie in an unexplored region and were discovered with the help of satellite imagery. Their gold reserves have three times higher grade than the international average. “There is 3.4 grams of gold per ton. The deposit is very close to the surface, and the ore body was formed about 20 million years ago. This indicates the likelihood of finding new such ore bodies in southern Mongolia. The existing deposits were formed 250 million-300 million years ago. So, there are ores formed 50 million-60 million years ago, closer to the surface. There is a lot of opportunities for Mongolia, considering that porphyry deposits have not been fully explored here.”

Hedley Widdup, Executive Director of Australia’s Lion Selection Group, noted how all the projects currently in the extraction or exploration stage in Umnugovi region, are deposits discovered before 2016. Some of these showcase Mongolia’s mineral potential to the world and draw the interest of international investors. Given sustainable implementation, they will be the main source of the exports that would feed the economy in the future. This is why geological studies have to lead the mining sector by 10-30 years. “Attracting investment in exploration is not easy. Low financing of exploration activities and decreasing investment will eventually have a negative impact on the mining sector. Exploration work should be conducted several years in advance in order to achieve some results. Including not only large, but junior companies as well, and attracting substantial investments from the market will make the mining sector stronger. Compared to 2016, the global trend of investing in the mining sector or buying shares of companies operating in the sector is increasing. Interest in investing in the technological sector is increasing in recent years. The first phase of the global market growth cycle is ongoing. The demand for raw materials used for batteries and gold production is increasing.”

Neil Young, Managing Director, Elixir Energy, provided details of its coal mine methane project in Umnugovi region and highlighted the advantage of an experienced foreign -- in this case Australian -- company entering the exploration sector in Mongolia. It made a product sharing agreement with the Government in September 2018 which stipulates that it would conduct exploration for 10 or more years. The area of the project is a flat desert, and the cost of building a gas pipeline is cheaper. Being close to the target market, China, gives it a strategic advantage. This export could use the high voltage transmission lines that now bring power from China to Mongolia. Besides exports, the company is also studying the needs of the domestic market. For instance, it could provide Oyu Tolgoi with energy produced from the coal mine methane. The company is also open to generating energy from renewable sources. It is an attractive idea because, given the proximity of China, it will be economically more efficient to do this than mining natural gas and supplying power at a high cost. If this works out, it will also diversify Mongolia’s export basket.

P.Gankhuu, CEO of Erdenes Mongol, revealed that the first drilling work, part of the exploration project of coal mine methane gas at Tavantolgoi taken up by an Erdenes Mongol subsidiary with Australian investors, has identified realistic reserves. The results will be formally published after they are reviewed by the Mineral Resources Professional Council. With Government support, Erdenes Mongol has successfully added to its assets since the last Discover Mongolia forum. The company’s subsidiaries now number 15, and it operates under direct supervision of the Government. Earlier this year, it acquired ownership of the uranium company, Mon Atom LLC, and also established Erdenes Alt Resources and Erdenes Silver Resources for the gold and silver deposits respectively now owned by it. It has also set up a research unit for rare earth elements. u

Projects for which investment is being sought include Erdenes Alt Resources’ gold refinery, a power plant at Baganuur deposit and the mixed metal Asgat deposit. Gankhuu was optimistic that now that all types of metals projects have been brought under it, the state-owned enterprise would be on firmer ground when negotiating with foreign investors and would also be able to take quicker decisions. Mega projects require mega investments, and it would be essential to offer legal protection to investors.

Cameron McRae, Chairman of the International Advisory Panel to the Minister of Mining and Heavy Industry, warned that one of the first things investors do is to assess the quality of the legal provisions and matters of jurisdiction. Projects initiated by the State tend to find costs exceeding initial estimates, and thus needing additional investment. Since it is not always easy to get this, the project pace slows down. Losing time means loss of money which adds to the need for fresh investment. All this leads to a loss of trust among partners. Politics also influences work on projects, as Mongolia knows only too well. Political parties should accept that some compromises have to be made on certain important issues. It is also a problem when politicians put the interests of individual aimags or even soums above those of the state.

Kirsten Livermore, Team Leader of AMEP-2 Program, is a three-time member of the Australian Parliament and worked as an Advisor to the Australian minerals industry until 2018. She feels that there is an absence of clear goals and strategies at the policy level in Mongolia. She said in her presentation, “Mining companies can operate and invest only in a sustainable policy environment which allows them to manage their risks. They need to know how Government policy changes and must be involved in policy-making. In big forums like Discover Mongolia, the government should provide clear information to companies about its policy and likely changes. Mining is a cyclical sector; and every project has a different cycle.

“Apart from when mineral and commodity prices are high, policy makers also need to carefully examine a project’s impact on other sectors. A general policy that does not consider every phase of a project is not realistic. Policy also has to be flexible. Between 2011 and 2016, Australia’s economic growth declined by 75%. We have bitter experience of miscalculating world market growth and our Central government’s policies and plans led to crises and an economic turndown. Some political parties were in disagreement over what to do because each cared for its own short-term advantages and its supporters, but at the end, they agreed to support the Government in order to safeguard the mining sector’s long-term interests and defend Australia’s reputation at the international level.

“That Australian politicians showed the domestic public and other countries that they supported the mining sector which is the main contributor to the national economy was vital for our economic recovery. Setting up a Mineral Resources Council, a joint organisation with shared understanding, started to show results in the mining sector. It has provided opportunities for the government, local authorities, government agencies, and companies to hold discussions, and suggestions and recommendations by the Council has been regularly helping in the sector’s development.”

Australians have been discussing how important the mining sector is and should be and also the proper way to develop it. Investment in mining has been declining since 2017 largely because of a 30% corporate tax. Livermore feels that this rate is too high for a country that needs foreign investment. The last government’s attempts to change the rate failed as Parliament did not agree. In February this year, the Government adopted the natural reserves statement, the first strategic document in the last 20 years of the Australian mining sector. The Minister of Mining announced steps to support new mining projects and there has been talk of providing tax incentives to junior exploration companies. Legal provisions that are seen as hindering the development of the mining sector are being reviewed for possible amendment and there is fresh focus on taking up new projects. Both major parties of Australia have expressed their full support for the sector. All this has helped show the world that Australia’s policy on and relations with the mining sector are transitioning to a new level.

Jean Pascal, Senior Economist (Mongolia, East Asia and Pacific) at the World Bank, noted how the Government of Mongolia and the World bank are working together on identifying ways to make optimal use of natural resources to convert them into social assets and said, “Natural resource-rich countries face a common problem of having cyclical, unstable economies, as this does not allow them to consistently utilize their full potential for growth. The mining sector plays a vital role in capital market development, and with the expansion of the capital market, people start to save. This in turn helps other sectors to come up and develop. At the moment, Mongolia cannot advance without the mining sector but if the income from it is spent on building human capacity, it will help the economy to have multiple pillars. Even though the economy is growing, poverty is not declining. To reduce poverty in Mongolia, other sectors should be developed and in this, income from mining will play a vital role. Therefore, we should concentrate on enhancing human capacity, investing in human capital and in advancing technology and innovation in industry.”

B.Byambasaikhan, Chairman of the Business Council of Mongolia, suggested that Mongolia should transform its perceived disadvantage of being landlocked into an advantage and become a “land bridge” country to link the supply of commodities. Investment in Mongolia will rise when Mongolia is ready and able to access new markets.