B.Tugsbilegt

Our Mining Minister wants a new, or newly-fashioned, sovereign wealth fund. Since he is a powerful man and works with determination, he is likely to get it. Once the necessary law is approved, D.Sumiyabazar would be known as Mongolia’s SWFMan.

We already have such afund but it has been struggling to work like a real SWF, and he wants to make things right. In 2017,the management of our country’s Fiscal Stability Fund was ranked at a middling 18th among 34 assessed in Natural Resource Governance Index. The proposed new law would be aimed at improving our score, modelling the fund after the Norway model.

Not so long ago, maybe because our only major export was copper, we thought about the wealth fund in Chile, the largest copper exporter globally, when we talked about having one. Then when we did have them, we were better at naming them than running them. We had a Human Development Fund (2009) and a Fiscal Stability Fund (2010). Unfortunately,our politicians’ penchant for populism did not allow the Human Development Fund to develop into full manhood. After remaining quiet for a while, we started looking for a real fund, for the future generation this time, we said, and came up with the Future Heritage Fund in 2017. So long this has been paying to the state budget what was due to it from the Human Development Fund and this year will be the first time some money will go into it --MNT550 billion from mineral export revenue. This and future savings will not be touched until 2030, if the law is followed. The Minister wants a new law to provide for smarter management tools for the fund.

It is good to have a model but it is better to have the right model. And though everybody talks about the Norway pension fund, a closer look might reveal that is it is not too appropriate for Mongolia. It is the largest wealth fund in the world, but its assets come from oil and gas, while our source is minerals. We should not lose sight of the fundamental difference between the two.Oil producing companies can be taxed heavily, even up to 80 percent, because once oil is extracted, it can be,and is in most cases,sold directly. Such a high rate of tax on minerals is almost impossible, as, for example, small pieces of the mineral have to be extracted from the ore before being sold.

And what exactly is the purpose of a wealth fund? It is saving for future generations from the current income from non-renewable reserves. These resources will, sooner or later, be depleted, and once the revenue flow stops or becomes weak and erratic, these savings will be used to keep up the country’s economy. It is by no means about free cash distribution, it is about saving for future. Our politicians are wrong when they say a wealth fund could be the solution to our current problems. This raises huge expectations among the public, but if they are to be met right now, the whole purpose of a wealth fund is lost.

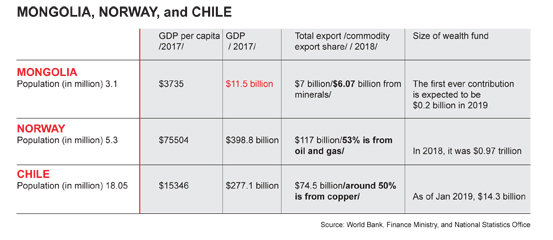

We also have to consider what the extent of our real wealth is.In absolute terms we might seem to have as much as Norway, but we must see this in context. Last year was the first time our export revenue reached $7 billion, of which $6.07 billion was from minerals, again the highest in the country’s history. But our GDP per capita is still as much as in 2017. But look at how much more Norway and Chile earn from their exports and you will know why their wealth funds are so much bigger than we can ever hope to have.

Let’s take a look ahead. Export revenue from Oyu Tolgoi was $1.18 billion last year and would reach $4.9 billion when peak production is reached. Other exports will also increase sharply in the medium term, and correspondingly more would go into the wealth fund. But resource nationalism and/or mismanagement could change all this. Any instability in the mineral sector, caused by wrong policy or otherwise, will affect contributions to the wealth fund, but this is always a possibility, and it is getting stronger. It is true that Norway nationalized all its natural assets, but this was done only after they had reached the capacity to conduct all exploration work themselves and had enough money of their own to invest in extraction. As for Mongolia, we cannot afford to do either, and, indeed, are in debt for Oyu Tolgoi.

The government wants to develop Erdenes Mongol as a kind wealth fund and to equally distribute its earnings among the public. But how much does Erdenes Mongol earn that it can be shared?No wonder, it is grabbing fresh assets such as the Asgat and Salkhit deposits.

Add to this what the Chief of Staff at the President’s Office, Enkhbold Zandaakhuu, said about taking back 400 mining licences into state ownership. The Prime Minister has expressed on several occasions his wish to get the state to own the Tsagaansuvarga copper-molybdenum deposit. So here at least is one thing where the Prime Minister and the President hold similar positions. The dispute over the 49% ownership of Erdenet has been revived, and it may not be long before Erdenet Mining Corporation is handed over to Erdenes Mongol. Its assets portfolio might grow, but if Erdenes Mongol has enough management skills to make all of them profitable is doubtful. And does it have the financial resources to make the huge investments necessary to develop these new acquisitions?

Forget the new ones, Erdenes Mongol is struggling to turnits present mines, such as Baganuur and Shivee-Ovoo, into profitable ventures. What will accrue in the wealth fund if your assets do not make reasonable, even if not substantial, profits?

Much of what the government and political leaders are saying is pure and simple pre-election posturing. The goal is to strengthen the voters’ faith in those offering such dreams and not Erdenes Mongol or a wealth fund. But if the government carries its act further, and does hand over some important mines to Erdenes Mongol, it might end upkilling the goose that lays the golden eggs. Overturning the mining sector would be an unpredictable risk for our country’s economy, already under the pressure of foreign debt. No IMF programme would be able to help us then. Meanwhile, professional bodies such as NRGI and Gerege Partners are warning that economic growth, especially in the mining sector, would start to slowdown from 2025.

Economists think we should use the mining revenue to repay our foreign debts rather than to build up a wealth fund. Investments from the wealth fund will not earn more than 4% return, whereas the interest we pay for foreign loans would be between 5% and 10%. Repayment pressure will be felt from 2021, and we should not make the mistake of selling more bonds to raise the money.

Presenting the Norway fund as a model and claiming before the people that we have more natural resources than Norway is to nurture gross misconceptions. Our exports will grow but they have to grow exponentially to take us anywhere near Chile and Norway. Bubbles can be comforting but they always burst, sooner or later, and when populist promises of building up mighty wealth funds and equal distribution of wealth are understood as so many mirages, it might be too late to relieve the unprecedent pressure on the state budget. The people who run the current government or the politicians now in power may not be there then, but “the people” will be.