Economy

EBRD LOWERS MONGOLIA’S GROWTH FORECAST FOR 2025

The European Bank for Reconstruction and Development (EBRD) has revised its regional economic forecast for 2025 downward by 0.2 percentage points compared to its projections from February 2025.

Preliminary Estimates of Economic Risks

It is impossible to predict with certainty the changes that may unfold in the global economy in the second half of 2025, or whether the direction of Mongolia's economy situation worsen or improve. It is equally difficult to calculate how the U.S. President's tariff policy, which is putting pressure on our neighboring countries and key business partners, will impact Mongolia, particularly through our main export market, China.

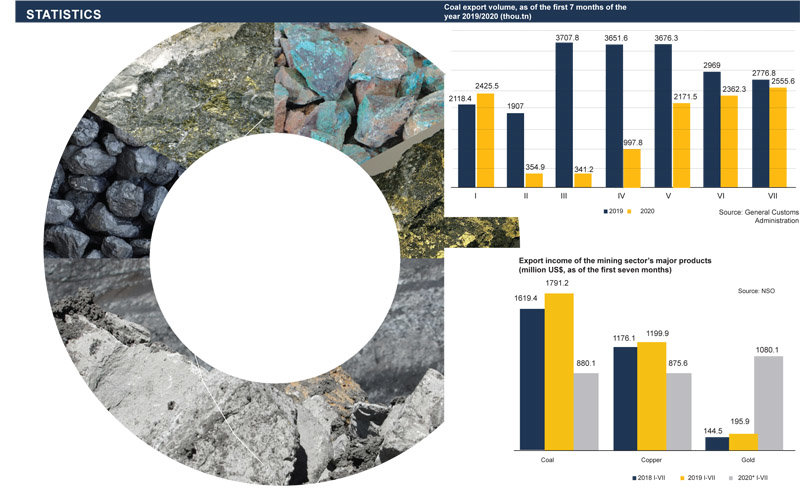

Compensating for Coal Price Declines Through Increased Export Volumes

On September 17, the National Statistics Committee released social and economic data for the first eight months of 2024. The report indicated that exports from our country reached $10.6 billion, while imports totaled $7.5 billion. During this period, the foreign trade balance recorded a surplus of $3.1 billion, though this figure represents a decrease of $935.6 million compared to the same period last year.

THE NEW REGIONAL DEVELOPMENT POLICY CANNOT BE ALLOWED TO FAIL

The draft resolution on declaring the current year as the Year of Regional Development Support was discussed and approved at a regular Cabinet meeting on 27 December 2023. During the break in the 2023 autumn session of the Parliament, officials were instructed to organize meetings and discussions to explain policies and regulations on regional development to the public.

Entering the new year in better form after economic recovery in 2023

It is time to assess the changes and reforms in Mongolia’s economy Mongolia during 2023. The national economy grew by 6.4% in the first half of 2023, and activity improved further in the third quarter, with growth reaching 6.9%. This was mainly influenced by the recovery of the mining and transportation sectors, and growth is expected to continue until the end of the year, emphasized B. Lkhagvasuren, President of the Mongol Bank, presenting the decision made by the Monetary Policy Committee 2023.

Justifying the expanded budget for the election year 2024

The 2024 budget figures can be explained by the upcoming elections, but if you look at them carefully, the budget includes the inevitable increase in salaries, pensions, and allowances approved by law,” Finance Minister B. Javkhlan said.

THE MONTH WHEN GLOBAL INVESTORS FLOCKED TO MONGOLIA

The “Mongolian Economic Forum - 2023” was held in Ulaanbaatar on 9-10 July. The investment conference was attended by more than 500 guests and representatives, including heads of well-known international investment organizations, economists, experts, and journalists from foreign media. It was organized on the occasion of the Year of Visiting Mongolia, just before the national holiday Naadam, to promote Mongolia and its culture and heritage

HOW CAN WE ATTRACT GLOBAL MONEY TO MONGOLIA ?

Foreign direct investment in Mongolia peaked in 2011 but fallen precipitously since then. Since the approval of the revised Investment Law in 2013, foreign investment in Mongolia has virtually ceased, with

President of Mongolia Ukhnaa Khurelsukh worked at the logistics center in Zamyn-Uud soum of Dornogobi aimag

On February 14, the President of Mongolia, U. Khurelsukh worked in Zamyn-Uud soum of Dornogobi aimag. It is the main logistics center that handles about 70% of freight and 30% of passenger traffic across the state border and generates 15% of customs revenue. The expansion and modernization of Zamyn-Uud infrastructure is being carried out in cooperation with the People’s Republic of China.The construction of the logistics center’s buildings, facilities and infrastructure began in 2019, and are 91% complete.

Government’s external debt policy challenges

During the last year, Mongolia’s external debt has increased by over $1 billion. Specifically, the first quarter government debt was 15.7 percent higher than during the same period last year. There is an expectation that the country’s external debt will continue to grow till the end of this year, but it would “easily fit” within the 70 percent limit set by law. The Ministry of Finance even presented an estimate indicating that this year’s total will be lower than the previous year compared to the GDP. According to the previous Fiscal Stability Law, the balance of government debt should have been kept at 60 percent of GDP this year. The implementation of this requirement has been delayed to 2024 under a budget amendment and is a result of the pandemic impacting the government’s goal. It is not a secret that the country

Will the limitation to the budget stability be continued to be violated?

In March of this year Finance Minister B. Javkhlan indicated it was to early to say if the budget spending limit would be amended. The minister stated “Although citizens are demanding and amendment to the budget, it is not an issue I can resolve. To date, budget expenditures have not been interrupted and investments have not stopped.” But the pandemic continues to worsen the border points remain closed and the national economy remains at risk. The current macroeconomic forecast for 2021 has “turned” from the original created earlier this year. It is expected that the budget deficit will increase to 8.8% of GDP, past the Budget Law limit and will require a new amendment. Last year the finance minister predicted that 2021 would be the year where Mongolia returns to complying with fiscal limits.

Lower lending rates are good, but not enough

The Government is in a commendable hurry to fulfil the MPP’s election promise that banks would not be allowed to charge more than 1 percent per month as interest on their loans. But how effective would this be in reactivating an economy crippled by the pandemic and, more important, can this one step in isolation do much to heal a seriously fractured financial system?

Folllowing Parliament’s adoption in August of a policy to reduce the interest rate on bank loans -- to 12% initially and then according to the situation over the next four years -- the Ministry of Finance, Mongolbank and the Financial Regulatory Commission are jointly working on putting flesh on the basic idea to ensure the best results for all stakeholders. As of now, six amendments to the present law governing the issue are planned to be submitted to Parliament for approval in its fall session.

Draft 2021 budget: better days beckon

Arguably the most important feature of the draft budget for 2021, awaiting approval by Parliament at the time of writing this, is its commitment to observing fiscal discipline, something that was made impossible this year by the pandemic. The budget deficit this year is expected to be 12.5 percent of GDP, much higher than allowed by law, but the 2021 draft puts it at 5.1 percent, which is under the permissible limit. In absolute terms, the deficit in 2021 would be MNT2.6 trillion less than this year’s. This has been achieved mainly by reducing expenditure by 4.3 percent from the 2020 level and by raising revenue, both in accordance with the Fiscal Framework Statement 2021, passed on 28 August, 2020.

With commodity prices rising, recovery is quite possible

With Parliament approving amendments to this year’s budget on August 28, the four months remaining of the year would be given to arresting, if not undoing, the damage the pandemic has been causing to the economy. Revenue is already MNT1.2 trillion less than expected and the budget deficit up to the end of June stood at MNT2.1 trillion, which had been estimated as the figure for the whole year. However, not all is lost. Rising mineral prices hold out hope that recovery is possible sooner than it seemed possible at one stage.

With an estimated revenue of MNT9.7309 trillion and projected expenses of MNT14.5775 trillion -- 25.2 percent and 37.7 percent respectively of GDP -- the revised budget shows a deficit of MNT4.8466 trillion or 12.5 percent of GDP, instead of the 5.1 percent in the original. This is obviously very high, and several drastic measures would be taken to see that revenue reaches the required level.

Banking reforms left to next Government; and banks under the present

Banking reforms would have to wait. The Spring session of the present Parliament, its last before members to its successor are elected, ended without completing discussions on them, presented as part of an economic package. Members of the Government were keen to make some progress on the reforms, and so was the IMF as part of its Extended Fund Facility package, but time was against them.

The ante was being upped even before the session began, with Prime Minister U. Khurelsukh saying on 27 March that the time was ripe to change the way the country’s commercial banks worked, warning that “if banks don’t accept our suggestion to reduce their lending rates, we shall have to take stern measures to see that this is done.” Finance Minister Ch. Khurelbaatar followed this up on 14 April, when he said in Parliament that after two years of calling for banking sector reforms and asking for Parliament’s permission to let foreign banks work in