Market

Mongolian coal can bring Russia and S Korea closer

Mongolia isn’t exactly what comes to mind when one thinks of East Asian or Pacific economic opportunities, yet for Russia, Mongolia is the key that it needs to unlock strategic relations with South Korea.

Rosneft to supply oil worth $1 billion in five years

Rosneft has signed two 5-year contracts for oil products supplies with Magnai Trade and Shunkhlai, committing itself to supply more than one million tons of oil products worth more than $1 billion at current prices between June 2014 and May 2019.

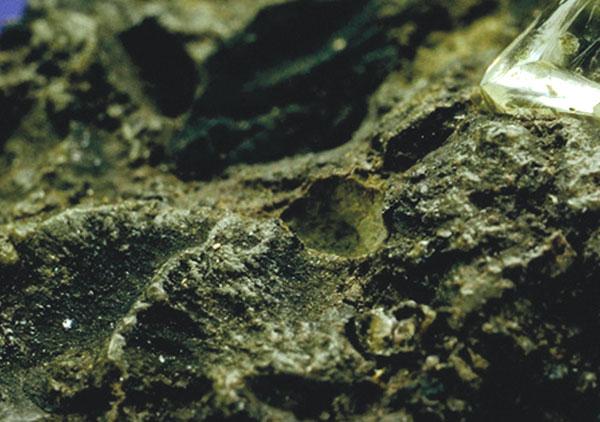

Mongolia’s gambit to boost gold reserve

In late January Mongolia enacted an amended gold royalty regime that lowers a gross tax on gold sales to 2.5 percent from up to 10 percent if a gold miner sells its production to the central bank. It’s a fascinating gambit by Mongolia to boost the size of its gold reserves, confidence in its inflating currency and growth of its official gold mining industry, which, according to reports, produced a modest 290,000 ounces gold in 2013, the vast majority of it exported.

China’s REE exports capping to have no short-term effect

Should the world’s largest rare earth elements (REE) producer China proceed to cap its exports within the next five years, it would probably not have a significant knock-on effect in the current global market, says critical REE project developer Frontier Rare Earths CEO James Kenny. He says the reason is that China is currently expected to fall short of its proposed 100,000 t/y export cap, leaving the present largely balanced market unaffected.

Alexander Molyneux’s hopes for ‘BHP Asia’ to be

Alexander Molyneux, a youngish former head of Robert Friedland’s SouthGobi Resources, is Blumont’s new Chairman and potential key shareholder. He has said that withe a strategy designed to make it a major miner. “We are on our way to become Asia’s BHP.”

Chances of 600.000 tonne per annum coal conversion plant brighten

Confirmation that Mongolian brown coal is suited for conversion into higher value products using Coal Plus -- a proprietary coal upgrading technology -- paves the way for Jatenergy’s agreement with Monrospromugoli to go ahead, and finally to result in a 600,000-tonne conversion plant that will generate annual royalties of US$1.76 million.

China’s iron-ore miners cut output as prices fall

A slide in iron-ore prices to three-year lows is forcing many high-cost miners in top consumer China to curb output, industry sources say, in a move that could reduce the surplus in a market weighed down by near record Chinese stocks.China produces about one-billion tons a year of iron ore and buys 60% of the steelmaking raw material traded globally.

Yanzhou Coal gets a breather in Australian takeover bid

China’s Yanzhou Coal Mining has crossed a key hurdle in the takeover of Australia’s Gloucester Coal and got an additional 12-month lifeline to bring down its stake in its Australian unit to less than 70%. Australian federal treasurerWayne Swan approved the deal between Yanzhou’s unit Yancoal and Gloucester Coal with some conditions and cited global market volatility as the reason for giving the Chinese more time to cut its stake.

China’s Economic Slowdown and Mongolian Stocks

Mongolian mining stock prices have been falling during the last six months, although not much has changed in Mongolia besides the talk of increasing the government share in Oyu Tolgoi in October. The reason for this cool-down is mostly due to the change in demand expectations for Mongolian mine products, because recent drops in key commodity prices and China’s declining industrial output indicate that China may be headed towards significant slowdowns.